History

The Accounting and Tax Applications Program took its first students in the 2000-2001 academic year and had its first graduates in 2002.

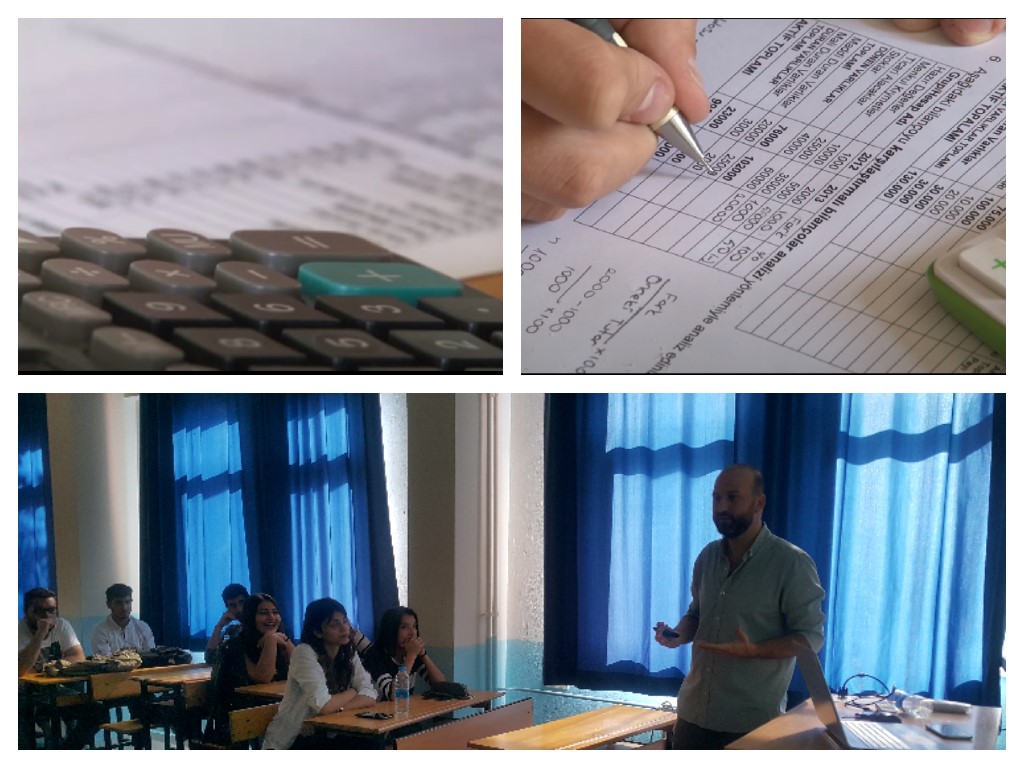

Aim

The main purpose of the Accounting and Tax Applications Program is to train entrepreneurial accounting personnel with analytical thinking ability, problem solving ability, who will meet the needs of accounting and financial advisory offices, accounting and finance departments of public or private sector organizations. Our students, who take part in the Accounting and Tax Applications Program, have information about the current developments in the field of accounting and gain command of accounting programs during their two-year education.

Academic Staff

In the Accounting and Tax Applications Program. There are 3 lecturers in total,

Graduation Requirements

Students must have a cumulative grade point average of at least 2.00 out of 4.00 and have completed a total of 40 days of professional internship in order to successfully complete and graduate all of the courses in the Accounting and Tax Applications Program for a total of 120 ECTS.

Internship

The students of the program can do internships in the offices of public accountants and certified public accountants, in the accounting and finance departments of enterprises under the supervision and control of public accountants and certified public accountants, in banks, in the accounting departments of municipalities, and in the accounting departments of professional chambers established by law.

Upgrade

Students who graduate by completing the program can gain the right to enroll in an undergraduate department (Business Administration, Economics, Finance, Accounting, International Trade, etc.) suitable for the program they graduated, if they are successful in the Vertical Transfer Exam given by ÖSYM.

Graduate Employment

Graduates are entitled to receive an "Associate Degree Diploma" with the title of "Accounting Professional". If our students wish, they may not complete their undergraduate education by transferring to the third year of the Open Education Faculty. In addition, if they do internship for three years after completing their undergraduate education and are successful in the Independent Accountant Financial Advisor exam, they can also have the title of "Certified Accountant and Financial Advisor". Students who successfully complete their two-year post-graduate courses can take positions as certified public accountants, certified public accountants, accounting departments of companies, banks and various private institutions as a result of the KPSS exam as a result of the KPSS exam.

Housing

here are many dormitories and rental flats in Ula or Muğla for the accommodation needs of our students.

Socio-cultural Areas

Our school is at the service of cafeteria, canteen, basketball court, volleyball court and carpet field. In addition, there is an indoor sports hall, swimming pool, football field and tennis courts, which the entire office is open to use during the flight of our university.

Department of Accounting and Taxation

Department of Accounting and Taxation

Undergraduate programs that students who have successfully completed the Accounting and Taxation Applications can transfer to if they are successful in the Vertical Transfer Exam (DGS) run by Student Selection and Placement Center (ÖSYM) are as follows: *

Labor Economics and Industrial Relations

Economy

Economics and Finance

Economics

Business

Logistics Management

Finance

Accounting and Auditing

Accounting and Finance Management

International Finance

International Finance and Banking

International Business Management

International Trade

International Trade and Finance

International Trade and Business

International Trade and Logistics

Management Information Systems

* DGS: Guide and Application Information